The HS Code is crucial for import and export activities as it appears on important documents like customs declarations, certificates of origin (CO/CQ), and commercial invoices. It provides basic data and directly influences tax rates and prices of goods during import and export processes. In the following article, we’ll be able to offer detailed information on HS Codes and how to look up HS codes accurately and easily.

What is HS Code?

HS Code (Harmonized Commodity Description and Coding System) is an international commodity coding system developed by the World Customs Organization (WCO). This system consists of 8 or 10 digits, standardizing the names, properties, and classification of goods globally.

The HS Code is very important in determining tax rates and managing international trade. This code applies to both tangible and intangible goods, based on the code of the container they contain.

For example: The HS Code of a movie will depend on the HS Code of the hard drive containing that movie.

The meaning of HS Code in import and export

HS Code is globally standardized, avoiding trade disputes due to local language differences.

In addition, the HS Code also plays an important role in determining tax rates, managing international trade, and implementing trade agreements. It is the basis for customs agencies, tax authorities, and chambers of commerce to license import and export goods. At the same time, it supports trade statistics and effective goods management.

For businesses, using the correct HS Code ensures compliance with the law and benefits from trade agreements. On the contrary, incorrect classification can lead to difficulties in delivery, inspection, and legal and financial risks.

Structure of HS Code

To look up HS Code, we use the tariff schedule. The tariff schedule consists of 21 parts and is divided into 98 chapters. Specifically:

21 parts include:

- Animals, plants, minerals, plastics, rubber;

- Stone products, jewelry, textile products;

- Machinery, electrical equipment, vehicles, and tools.

98 chapters include:

- The first 97 chapters classify general goods;

- Chapter 98 classifies preferential goods (goods purchased by the Ministry of National Defense).

Businesses usually only need to pay attention to the first 97 chapters, and only tangible goods are identified in the tariff schedule.

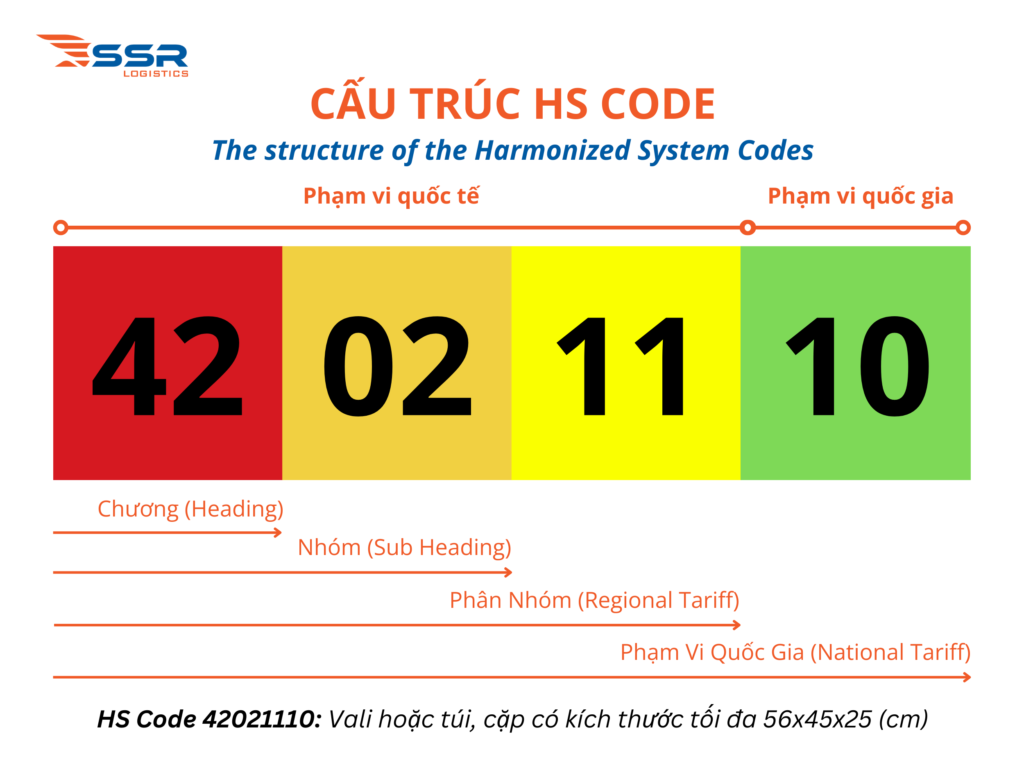

Heading: includes 2 characters after the chapter, showing the classification of product groups.

Subheading: includes 2 characters after the group, more detailed below the group.

Regional Tariff: the last characters are determined by each country.

Note: Heading, subheading, regional tariff (first 6 digits) are international, while national tariff may vary according to the regulations of each country.

Vietnam currently applies an 8-digit HS Code for goods. Some other countries may use a 10–12 digit HS Code.

The structure of HS Code

For example: When looking at the HS Code 420211100, we can completely get the following information:

– 42: Shows Heading – Articles of leather; saddlery and harness; travel goods, handbags, and similar containers; articles of animal gut (other than silkworm gut).

– 02: Shows Subheading – Trunks, suitcases, vanity cases, briefcases, briefcases, school bags, satchels and similar containers.

– 11: Shows Regional Tariff – Outer surface of leather or composition leather

– 10: Shows National tariff – Suitcases or satchels, satchels with maximum dimensions of 56cm x 45cm x 25cm

Rules of looking-up HS Code

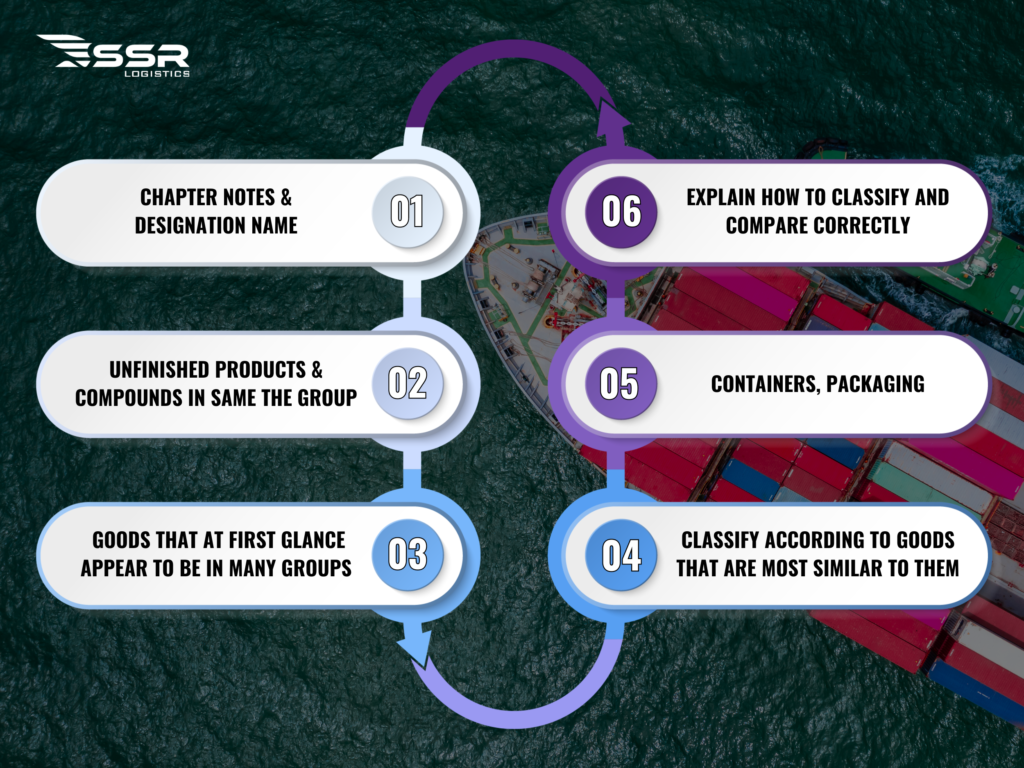

To look up HS Code, we follow 6 rules from rule 1 to rule 6. Only use the following rule when the previous rule cannot be applied.

Rules for looking HS Code up correctly

Rules for looking HS Code up correctly

Rule 1: Chapter notes & Designation name

The names of heading, subheading, and regional tariff in the HS Code system do not have legal value in classifying goods. They only help to define which type of goods belongs to which section and chapter. Because the names of heading, subheading, and regional tariff cannot cover all products, we need to rely on notes and sub-groups for accurate classification.

The notes of each chapter are the decisive factor in classifying goods in that chapter and are valid throughout all other rules. Therefore, when looking up the HS Code, it is necessary to carefully check the notes of the relevant section and chapter to determine the product code accurately.

For example: Determine the HS code of a 230-liter Toshiba refrigerator

- Step 1: Define the area that can be applied to Chapter 84: Nuclear reactors, boilers, machinery, and mechanical appliances; their parts

- Step 2: Read the regional notes (if any)

- Step 3: Read chapter 84 and look at the chapter notes: identify the Toshiba 230 refrigerator as belonging to heading 8418 and the correct HS code is: 84181011

Rule 2: Unfinished products & Compounds in the same group

Rule 2a: Unfinished products

An incomplete item, missing some parts, but still having the same characteristics and uses as the finished product will be classified under the code of the finished product.

Rule 2b: Compounds in the same group

This rule applies to products which are mixtures of materials and substances. If a mixture or compound of materials or substances belongs to the same heading, it will be classified in that heading. However, if a mixture or compound consists of materials or substances belonging to different headings, the HS Code will be determined based on the main constituent of the mixture.

Rule 3: Goods that at first glance appear to be in many groups

Rule 3a

Where goods are described in more than one heading, the heading that provides the most specific description shall take precedence over the headings that provide the most general description.

Rule 3b

Goods are made up of several products, each of which may belong to several different headings and chapters. Therefore, the classification of the set of products shall be in the product that has the most characteristic character of that set.

Rule 3c

When rules 3a or 3b cannot be applied, the goods shall be classified according to Rule 3c. The goods shall be classified in the heading which is the last in order among the headings which are considered for classification.

Rule 4: Classify according to the goods that are most similar to them

Compare the goods to be classified with previously classified goods based on factors such as description, characteristics, properties and intended use. After comparison, the goods will be classified into the group of the most similar goods.

Rule 5: Containers, packaging

Rule 5a: Boxes, bags, sacks and similar packing containers

Các loại bao bì, hộp đựng đặc biệt hoặc có hình dạng cụ thể để chứa đựng hàng hóa hoặc bộ hàng hóa xác định, có khả năng sử dụng lâu dài và đi kèm với sản phẩm khi bán, sẽ được phân loại cùng với những sản phẩm đó. Tuy nhiên, quy tắc này không áp dụng đối với bao bì có giá trị hoặc tính chất nổi trội hơn so với hàng hóa bên trong.

Rule 5a: Packaging

This rule regulates the classification of ordinary packaging used to pack and contain goods when imported together with the goods (plastic bags, carton boxes, etc.). However, this rule does not apply to reusable metal packaging.

Rule 6: Explain how to classify and compare correctly

The classification of goods in subheadings of the same heading must fully comply with the content requirements of each heading, by the subheading notes, and by the notes to the relevant chapters. When comparing products between different headings or subheadings, the comparison must be made on the same level.

Benefits of looking HS Code up correctly

Looking up the correct HS code brings many important benefits in import and export activities:

- Reduce risks and avoid the situation of goods being detained or returned, thereby saving time and costs.

- Comply with legal regulations related to import and export and avoid legal consequences such as fines or lawsuits.

- Avoid unnecessary fees and fines for violating regulations, thereby minimizing the overall cost of import and export activities.

- Support searching for information on legal regulations and fees quickly and accurately. Thereby improving the efficiency in managing and implementing import and export activities.

SSR Logistics – A reputable, complete unit for looking up HS Code correctly and doing customs procedures

HS Code is required in the import and export process. Understanding this importance, SSR Logistics was born with the mission of becoming a reputable partner to support businesses in looking up accurate HS Code and performing reputable, complete customs procedures.

Why Choose SSR Logistics?

- Experienced team of professionals;

- Streamlined processes;

- 24/7 dedicated support;

- Competitive Pricing.

SSR Logistics looks up HS Code correctly and does customs procedures with prestige and complete package

SSR Logistics looks up HS Code correctly and does customs procedures with prestige and complete package

Lookup HS Code exactly and do the reputable, complete customs procedures of SSR Logistics including:

- Free consultation on Customs procedures

- Support in preparing complete and accurate Customs procedures

- Submit documents and monitor the progress of Customs procedures

- Consult on solutions in case of problems

- Provide import and export freight services

With SSR Logistics, you can be completely assured of an accurate HS Code lookup and reputable, complete customs clearance. We are committed to providing you with professional, reputable and effective services, helping you save time and money.

Through this article, SSR Logistics hopes that customers have an overview of HS Code in import and export. To explore more diverse knowledge in the field of logistics, please visit our Logistics Knowledge section.

SSR looks forward to becoming your reliable logistics partner, providing optimal solutions for your import and export business. If you have questions about our services, please contact us for specific advice.

With our experienced team, extensive network and flexible shipping & customs solutions, SSR Logistics is confident to deliver excellent services to our clients.

Businesses that need customs and import-export, please contact SSR Logistics via Hotline (+84) 911 988 484 or leave your information here for specific advice.

With a modern warehouse system and experienced transportation staff, SSR Logistics provides a variety of additional services such as: customs clearance, warehouse leasing, domestic transportation, international transportation by sea and air, and international express delivery.