The demand for air freight in June experienced a significant leap, specifically a 13% increase compared to last year. There are no signs of this trend slowing down soon, and the market forecast for Q4 predicts a very bustling period.

With the current growth, many experts predict that the fourth quarter will be extremely busy

With the current growth, many experts predict that the fourth quarter will be extremely busy

The growth of air freight volume in June

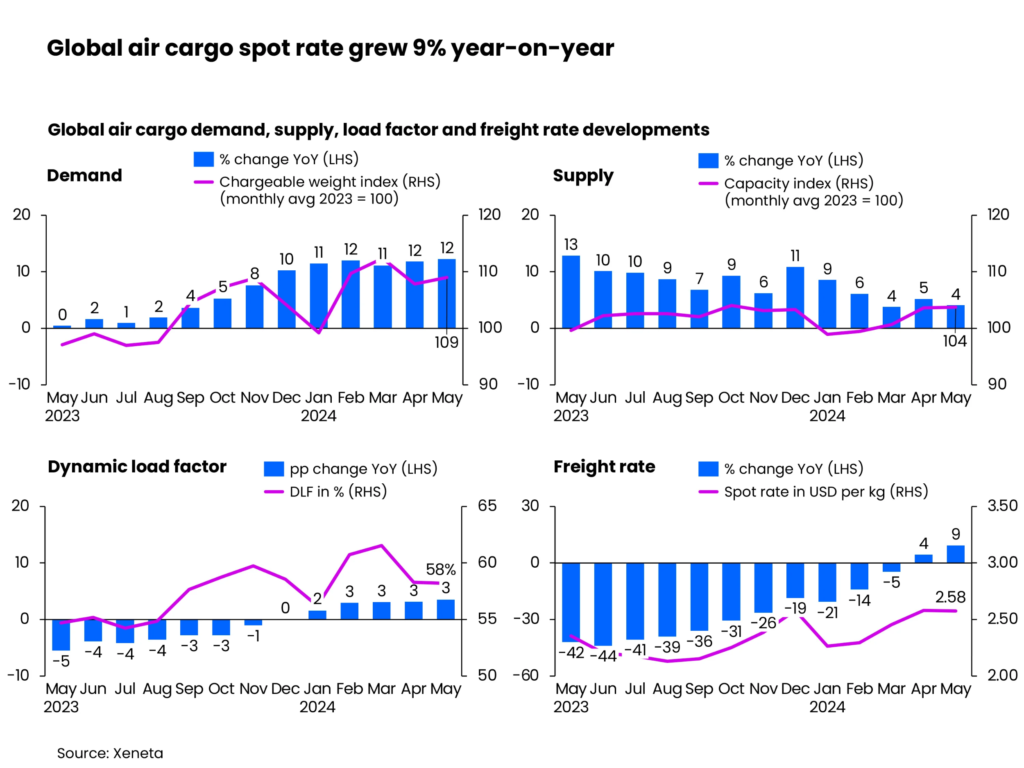

According to the latest analysis from Xeneta, the global air freight market is heading towards a “bustling Q4” with six consecutive months of growth, particularly in June, which saw a 13% increase compared to the same period last year. However, it is also predicted that if carriers and freight forwarders are not well-prepared for this year’s peak season, they might be dominated by market forces.

Despite the strong increase in air freight demand in June, the supply of cargo capacity only grew by a modest 3%, resulting in a global load factor increase of 4%. Consequently, businesses are strategizing to tackle challenges and seize financial opportunities in Q4.

Global air freight increased by 9% year-on-year

Global air freight increased by 9% year-on-year

Expert assessment of the growth in air freight volume in June

Expert assessment

“The growth in demand in June is not surprising, and we anticipate continuing to see double-digit growth year-over-year in July and August due to the low demand during the same period last year. The global system is operating steadily at this level, but this might be the calm before the storm regarding air freight rates,” remarked Niall van de Wouw, Xeneta’s Chief Air Freight Officer. “I have heard that some airlines and forwarders are considering implementing peak season surcharges by the end of August. There is consensus that Q4 will be very dynamic for air freight in many Asian markets.

“We predict that demand growth will be lower year-over-year in the second half of 2024 due to the strong growth in Q4 of 2023, but if you haven’t secured enough capacity for Q4, you might face challenges. Carriers will have to pay more throughout Q4, and the question is, how much more will they have to pay?” he added.

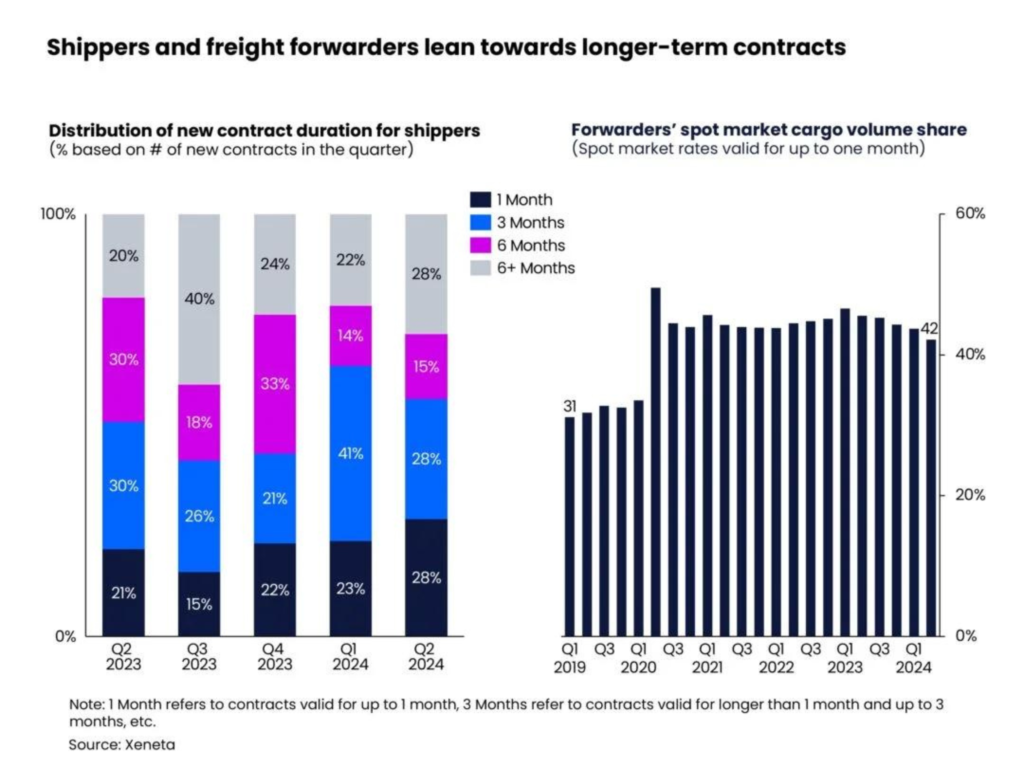

According to Xeneta’s analysis, carriers and forwarders lean toward long-term contracts.

According to Xeneta’s analysis, carriers and forwarders lean toward long-term contracts.

Regarding demand and supply in the final quarter of 2024, Niall van de Wouw stated that “the rules of the game have become clear.” Freight forwarders and carriers with fixed contracts in congested markets, based on fixed volumes and peak season surcharges, will mitigate risks. In contrast, those relying on the spot market will face significantly higher fees.

“In 2023, the market did not anticipate the demand we saw. This year is different. Carriers with fixed contracts will be better prepared, but if they exceed the agreed thresholds, they will have to pay market rates. In the short-term spot market, this could lead to price increases of +50% over current levels when the market heats up.

“Asset owners will strategize; retaining a portion of capacity to sell at higher rates when this happens. If you are an airline, you will ensure to hold back some capacity to sell at premium prices in the short-term market,” Van de Wouw explained.

Causes of the growth in air freight volume in June

The surge in e-commerce, disruptions in sea transportation caused by the conflict in the Red Sea, and the overall enhancement in global manufacturing activities are the primary factors propelling global air freight spot rates higher in June. This is the highest increase this year, up +17% year-over-year to $2.62 per kilogram.

Measured month-to-month, air freight spot rates rose +2% in June, as demand for transportation increased by +4% compared to the previous month, surpassing the available capacity.

By region, Southeast Asia to Europe and US lanes saw the highest increase in spot rates in June, up +14% from May to $3.65 per kilogram and $5.32 per kilogram, respectively. The Northeast Asia to Europe and US lanes also saw slight increases, up +5% to $4.26 per kilogram and +4% to $4.00 per kilogram.

In contrast, the export market from China slowed, with rates from China to Europe and the US both decreasing by -1% to $4.09 per kilogram and $4.80 per kilogram, respectively. Rates from Europe to the US fell by -4% to $1.69 per kilogram due to increased belly capacity from summer passenger flights.

Expert forecast for the market in Q4

There is a lot of uncertainty in the market looking forward. The most recent Purchasing Managers’ Index (PMI) shows a slowdown in industrial production in June. Specifically, the sub-index for new export orders declined for the first time in three months. This decline aligns with soft retail sales in the US and Europe, even with decreasing inflation.

Due to potential market volatility and a possible surge in air freight rates in Q4, carriers are adjusting the preferred length of their contracts. In Q2 2024, contracts longer than six months were the most popular, with the rate increasing to 28%. Carriers are opting for longer contracts to avoid significant rate fluctuations during the upcoming peak season.

The decrease in three-month contracts reflects carriers’ concerns about renegotiating rates just before the year-end peak season. Similarly, freight forwarders are buying less volume on the spot market. In Q2 2024, the proportion of cargo volume purchased on the spot market accounted for 42% of the total market, which is a 3% decrease compared to the previous year.

“As we enter the second half of the year, the time to consider long-term contracts might be now or never. With the sea transportation chaos, growth in manufacturing activities, and fear of missing out, the balance between short-term and long-term contracts is on everyone’s mind. It remains to be seen, but regardless, shipping goods from the Asia-Pacific region will likely become more expensive come September,” Van de Wouw said.

See other articles in our Logistics News section.

Businesses that need customs and import-export consulting between Vietnam and Korea, please contact SSR Logistics via Hotline (+84) 911 988 484 or leave your information here for specific advice.

SSR Logistics is the leading provider of reputable customs brokerage and international freight services in Vietnam. With over 15 years of experience in the logistics industry, we emphasize transparency, legitimacy and are committed to providing comprehensive solutions that save costs and time for customers.

With a modern warehouse system and experienced transportation staff, SSR Logistics provides a variety of additional services such as: customs clearance, warehouse leasing, domestic transportation, international transportation by sea and air, and international express delivery.