Selectivity of customs declaration form is the process of classifying imported and exported goods based on risk levels to apply appropriate inspection methods. This is an important tool to help the Customs authority improve management effectiveness while facilitating enterprises’ importing and exporting activities.

The article will provide readers with basic information on customs clearance channelization, including concepts, objectives, significance, steps to implement the channelization process. Hopefully this will help readers gain more understanding of this trade facilitation policy.

Customs Declaration Form Selectivity

Definition of Selectivity of Customs Declaration Form

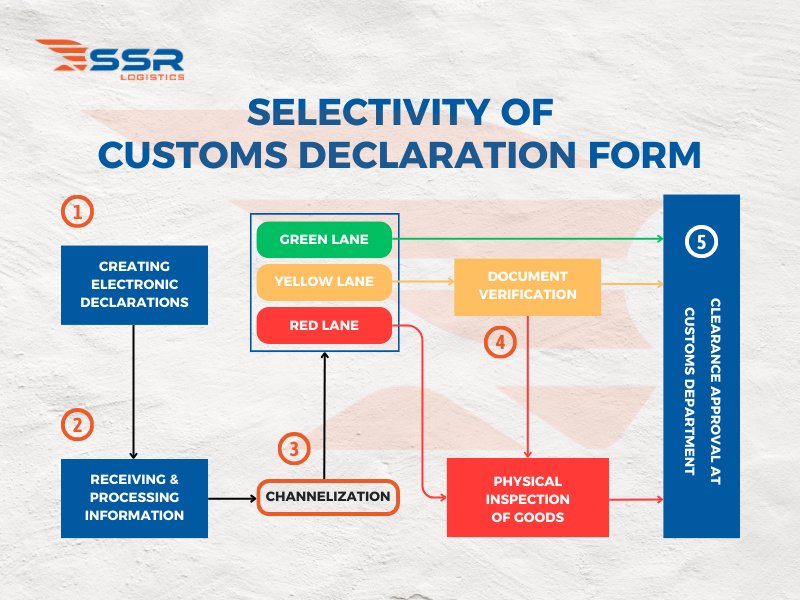

Selectivity of customs declaration form is the process of customs authorities categorizing enterprises’ import and export declaration forms into different channels with varying levels of inspection, supervision and handling. The channelization is based on risk management principles, appropriately prioritizing shipments for expedited clearance or intensive checks.

Specifically, after submission into the system, customs will analyze and evaluate declaration forms based on risk criteria to decide the categorization into green, yellow or red channels. Each channel has different clearance procedures regarding duration, inspection requirements and document supplementation to ensure work efficiency.

Objectives of Selectivity of Customs Declaration Form

- To improve the efficiency of customs supervision and inspection by focusing resources on high-risk goods.

- To reduce the burden for reputable and compliant importing/exporting enterprises.

- To speed up the clearance process for imported and exported goods.

- To ensure fairness and transparency in customs evaluation and inspection.

Selectivity of Customs Declaration Form

Significance

The selectivity of the customs declaration form will help authorities enhance risk management efficiency and enterprises’ compliance. It also facilitates importing and exporting activities to be conducted smoothly, safely and legally.

Types of Lanes in Selectivity of Customs Declaration Form

Green Lane – What is the green customs lane?

Green lane declaration code: Code 1

The green customs lane is a fast-track channel for imported and exported goods that meet customs requirements.

Characteristics of Green Lane:

- Applies to goods with low-risk levels.

- Goods have fully complied with declaration and customs procedures.

- Electronic declarations are promptly processed and cleared by the system.

- No additional document checks are required.

Green Lane applies in cases such as:

- Importing enterprises have trusted partnerships and reputations, with a history of safe and reliable exports.

- Goods are production materials with clear origins and sources, verified and inspected at the exporting port or previous points.

- The information declared is accurate, complete, and aligned with supporting documents.

- Full compliance with pre-arrival customs regulations and clearance.

The Green Lane helps shorten clearance time and reduce costs for enterprises.

Yellow Lane – What is the yellow customs lane?

Yellow lane declaration code: Code 2

The yellow customs lane applies to imported/exported goods with medium risk levels, which are lower than the red lane but still require some verification checks.

Characteristics of Yellow Lane:

- Not suspicious goods or serious violations.

- May have been inspected by the exporting country’s customs.

- Random inspections to ensure compliance.

- The information is mostly complete but some details need clarification.

Yellow lane applies in cases such as:

- High-value electronics, machinery and equipment.

- First-time or changed item import compared to before.

- Some declared information requires accuracy verification.

The yellow lane has faster clearance times than the red lane but enterprises need to provide complete and accurate information and documents to avoid delays.

Red Lane – What is the red customs lane?

Red lane declaration code: Code 3

The red lane in customs clearance channelization is often applied to goods subject to strict inspection or suspicion of non-compliance.

Characteristics of Red Lane:

- Detailed examination of all documents, records and declared information.

- Physical inspection, measurement and counting of goods.

- Lengthy processing time, depending on the severity of the violation.

Red lane applies in cases such as:

- High-value goods.

- Goods with unclear origins or sources.

- Special industry goods like pharmaceuticals or food.

- Detained goods due to customs-related issues.

When goods enter the red lane, inspections and reviews may be prolonged, causing longer clearance times and higher costs for enterprises.

Some common reasons for customs declarations to be laned into the red lane:

- Inaccurate, incomplete, or inappropriate declaration information.

- The company has a history of tax arrears or penalties for commercial fraud.

- Frequent modifications or cancellations of declarations without valid reasons.

- Signs of illegal cross-border transportation, smuggling or tax evasion.

- Failure to provide required import-related documents upon customs’ request.

- Lack of cooperation in providing business information to assess compliance.

These reasons can lead to tighter inspection lanes to ensure compliance with regulations.

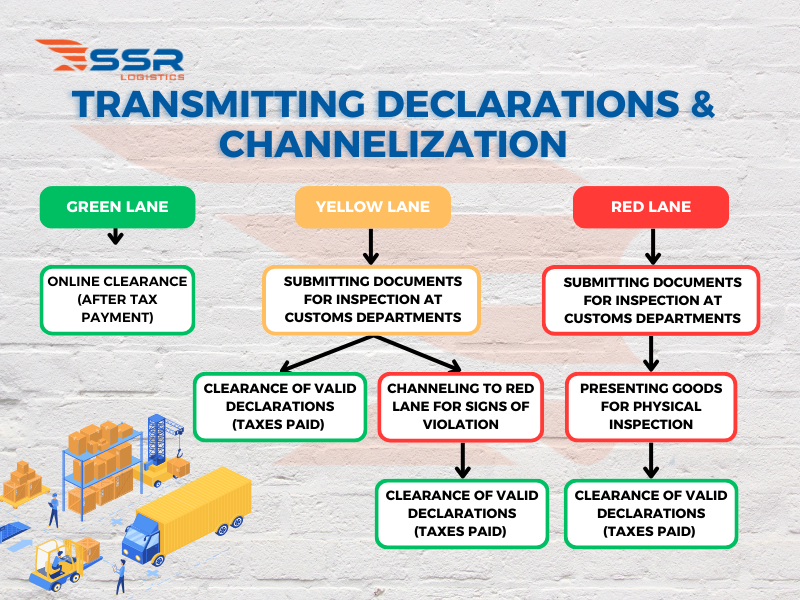

Customs Clearance Channelization Process

Step 1: Receiving Customs Declaration

Enterprises declare detailed information about imported/exported goods such as product name, quantity, type, origin, value, ports of import/export, etc. Relevant documents like contracts, invoices, packing lists and other certificates are attached.

Step 2: Preliminary Information Check

Customs authorities will check basic information in the customs declaration for accuracy and completeness. This includes verification of customs code, place of import, date of import and other key details.

Step 3: Customs Channelization

Based on declaration info and risk assessment, customs will channel goods into 1 of 3 lanes:

- Green Lane: for low-risk and compliant goods

-

- No additional checks required

- Prioritized for quick clearance

- Yellow Lane: for medium-risk goods

-

- Some supplementary document and transaction rationality checks

- Physical inspection may be required prior to clearance

- Red Lane: for high-risk goods

-

- Strict documentation and physical checks

- Detention or liability consideration may apply

Channelization will be automatically conducted by the risk assessment system to ensure objectivity and accuracy.

The Lastest Customs Clearance Channelization Process

Step 4: Detailed Goods and Document Inspection

For Yellow and Red lanes, customs will thoroughly examine information, documents and physical goods:

- Validate alignments among supporting documents like invoices, packing lists, freight documents, etc.

- Count, and measure goods to verify declaration.

- Check origin, CO/CQ confirmation.

- Examine signs, labels on good packaging.

Step 5: Clearance Decision

Based on verification results, Customs decides on clearance approval or refusal. Outcomes are updated in the system and notified to the enterprise.

The stringent channelization process enables customs to strictly monitor import/export activities for trade facilitation and efficiency. Comprehensive inspections help prevent counterfeits, smuggled or substandard quality goods.

Customs Clearance Services at SSR Logistics

SSR Logistics is the leading provider of reputable customs clearance and international freight services in Vietnam. With over 15 years of experience in logistics, we emphasize transparency, legitimacy, and commitment to comprehensive, cost and time-saving solutions for customers.

SSR Logistics helps make your customs declaration process safer through expedited procedures with the following services:

- Consultancy on customs documentation

- Appropriate HS code selection

- Checking import/export documents

- Making customs declarations

- Transmitting customs declarations

- Advisory on imported goods quality inspection

- Import price valuation advisory

- Representing cargo owners to work with customs authorities and shipping lines

- Services for food safety and hygiene certificates

- Services for CO, CQ, etc.

The benefits for customers using SSR Logistics’ customs brokerage services:

- Highest green lane success rate in the market

- Fast customs clearance

- Saving on declaration, warehousing and freight costs

- Professional and enthusiastic staff

- Insurance support for imported goods

Through this article, it’s clear that customs clearance channelization plays a crucial role in directly affecting clearance time and costs for enterprises’ imports. Accurate and complete declaration information will facilitate smooth processes and avoid costly errors or violations. Thus, enterprises must focus on compliance to safeguard reputation and business performance. View more articles in our Logistics Knowledge section.

If encountering any difficulties in customs declaration, companies can contact SSR Logistics for support. With experienced specialists and comprehensive advisory solutions, SSR Logistics commits to bringing convenience, cost and time savings for your import operations.

Along with customs brokerage, with a modern warehouse system and specialized transport staff, SSR Logistics also supplies various complementary services such as warehouse leasing, domestic transportation, international transportation by sea and air, and international express delivery.