China is one of the world’s most cost-efficient production hubs, resulting in high demand for imported goods from this nation. Vietnam is no exception to this trend. However, importing goods from China to Vietnam involves several intricate steps and requires the validation of various legal documents, which not everyone may be fully aware of. This article aims to provide details of importing goods from China, equipping readers with a clear understanding of the necessary procedures and documentation.

Why Are Import Formalities Necessary?

Import formalities are essential for several critical reasons:

- Legal Compliance: Ensures that imported products comply with origin, quality, and safety regulations.

- Contributing to the National Budget: Import procedures involve paying import duties, value-added tax (VAT), and other fees. This boosts state revenue and provides resources for socio-economic development activities.

- Trade Management and Control: Allows customs authorities to manage and control the volume of goods entering the country, preventing smuggling and illegal trade activities, and protecting the domestic economy from unfair competition.

- Consumer Protection: Import procedures include quality and safety checks, ensuring that consumers are not exposed to substandard or hazardous products.

- Trade Statistics and Analysis: Provides data for international trade statistics and analysis, enabling the government and businesses to accurately assess trade conditions and develop appropriate strategies.

- Supporting Businesses: Helps businesses plan their business strategies and manage their supply chains effectively, ensuring legally imported goods, minimizing risks, and optimizing logistics processes.

Types of Importing Goods from China

Vietnam and China have a long border, making customs clearance very convenient. Consequently, there are multiple methods for importing goods from China to Vietnam. The most common methods are official import and small-scale import.

Small-Scale Import from China

Small-scale import is a form of legal international trade conducted between residents of Vietnam and China (those who have permanent residence in border areas). Simply put, small-scale import involves transporting goods from one country to another through the border without passing through official checkpoints.

Although it doesn’t go through official checkpoints, this method still requires a customs declaration, tax payment, and quarantine tax, and is subject to strict inspection and supervision, like official import. In Vietnam, small-scale imports typically occur in border provinces such as Quang Ninh and Lang Son.

Official Import from China

Official import is the process of importing goods in large quantities through the Vietnam-China border checkpoints. Currently, there are two primary methods of official import from China to Vietnam:

Direct Official Import

In this method, the buyer and seller conduct transactions directly and import goods through checkpoints in large quantities. This requires both parties to have a complete sales contract, with goods thoroughly inspected by relevant authorities. All procedures must be completed, and taxes paid in full before customs clearance.

Indirect (Entrusted) Import

In this method, goods are imported through an intermediary. The buyer does not import the goods themselves but authorizes service companies to handle the import process. These companies are responsible for transacting with the seller, inspecting the goods, and completing all import procedures, saving the buyer time and minimizing risks associated with importing goods from China

Import Procedures for Chinese Goods via Small-Scale Import

When importing goods from China through small-scale import, the process is relatively simple and cost-effective. It’s important to ensure compliance with all customs and inspection procedures.

Declaration Procedures

First, visit the customs office to declare the goods and pay the necessary taxes. Required documents include:

- Border resident identification;

- Small-scale import business license;

- Any other declaration documents as required by customs authorities

Goods Inspection Procedures

After completing the declaration procedures, follow these steps for goods inspection:

- Bring the goods to the checkpoint for inspection;

- Customs officers will inspect the goods in the presence of the owner;

- The inspection results will be compared with the related documents and recorded;

- Based on the documents and inspection results, customs will determine the tax payment and clearance of the goods;

- The documents and procedures will be processed and retained at the border checkpoint customs office.

Importing Goods from China via Official Import

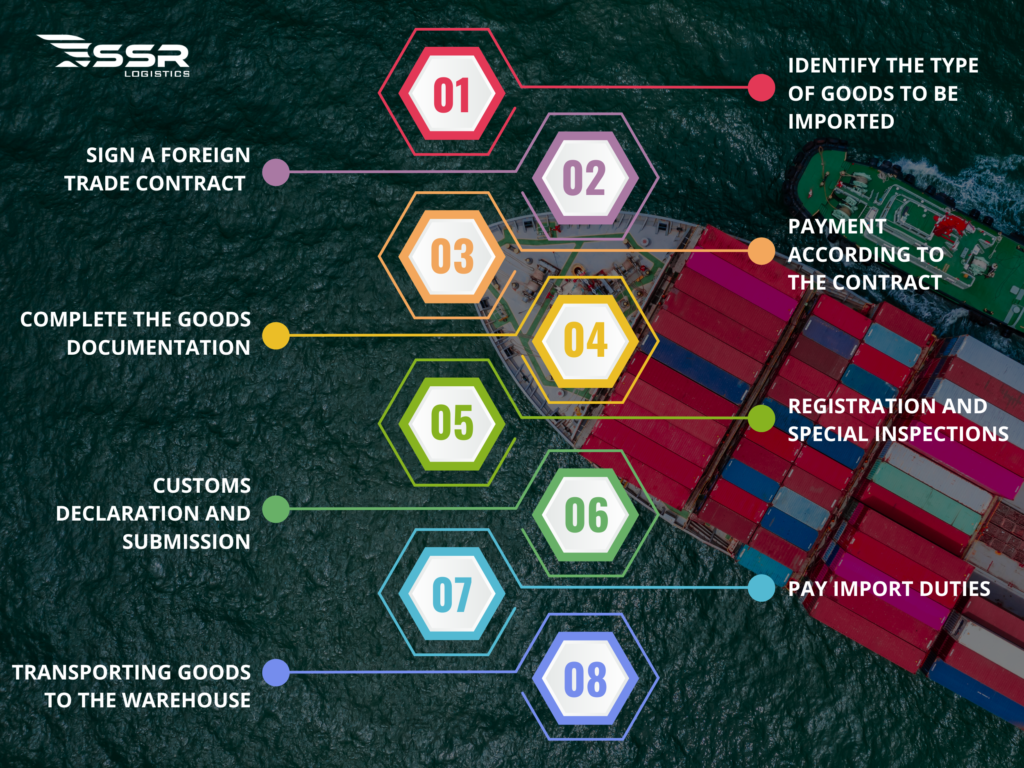

Importing Goods from China is complex and involves multiple procedures. Generally, you will need to follow these eight steps:

Importing Goods from China to Vietnam

Identify the Type of Goods to Be Imported

Determine which items are permitted for import into Vietnam and prepare the appropriate documentation.

- Prohibited Goods: These are listed in Annex I of Decree No. 69/2018/ND-CP and include items like consumer goods, medical devices, narcotics, weapons, and used vehicles.

- Goods Requiring Special Inspection: Items such as plants, animals, and their products must undergo food safety and quarantine checks.

- Goods Requiring Import Permits: These are listed in Annex III of Decree 69/2018/ND-CP. Obtain necessary permits from relevant authorities before importing.

Goods not listed in the above categories are considered regular commercial goods, and you can proceed with standard import procedures.

Sign a Foreign Trade Contract

To find reliable suppliers, use sources such as trade fairs, trade associations, and trusted vendors. Contact suppliers to discuss orders, and assess production capabilities, product quality, and pricing.

A foreign trade contract is essential for import procedures. Sign this contract after agreeing to the terms with the supplier. Key contract terms include:

- Specify the item names, quantities, and total amounts matching the invoice, packing list, and bill of lading;

- Determine the goods’ origin, ensuring smooth customs clearance;

- Payment terms, delivery time, and shipping schedule.

Payment According to the Contract

Make payments based on the agreement using methods such as open account, remittance, collection, letter of credit (L/C), or authority to purchase.

Complete the Goods Documentation

To complete customs procedures for importing goods from China, prepare the following documents:

- Sales Contract

- Commercial Invoice

- Packing List

- Certificate of Origin (C/O) Form E (if applicable)

- Customs Declaration

- Bill of Lading

- Phytosanitary Certificate

- Other documents (Quality Inspection, Fumigation Certificate, Compliance Certificate…)

Registration and Special Inspections

For goods requiring quality checks, register for inspection upon receiving the arrival notice. This ensures that imported goods from China meet legal standards.

Customs Declaration and Submission

Upon receiving the arrival notice, submit the customs declaration via the VNACCS system of the General Department of Customs. Prepare documents based on the customs clearance results:

- Green Lane: Follow regulations; no document check is required.

- Yellow Lane: Customs checks the shipment documents. If valid, the goods are cleared.

- Red Lane: Detailed inspection of documents and goods. Additional costs may occur.

Pay Import Duties

Pay the necessary import taxes, including:

- Import Duties

- Value Added Tax (VAT)

- Other taxes (Environmental Tax, Special Consumption Tax, etc.)

Transporting Goods to the Warehouse

After completing customs procedures, businesses need to arrange transportation to move the goods to the warehouse. It is important to select a reputable carrier to avoid loss or damage during transit.

The procedure for importing goods from China to Vietnam is quite complex, so many businesses opt for the comprehensive services provided by logistics companies to save time and ensure efficiency.

Key Considerations for Importing Goods from China

To ensure a smooth and efficient import process of goods from China to Vietnam, it is crucial to pay attention to the following points:

- Verify Goods Information: Check the origin, labels, and packaging of the goods to make sure they are of good quality and to minimize risks.

- Prepare Complete Documentation: Make sure to have all the necessary documents ready, such as invoices, sales contracts, certificates of origin, and any other required paperwork to help with customs clearance.

- Understand Prohibited Goods Categories: Please refer to Annex I of Decree No. 69/2018/ND-CP to ensure compliance and avoid legal issues related to prohibited goods categories.

SSR Logistics – Reliable Customs Clearance Services Provider for Importing Goods from China

Importing goods involves mandatory procedures and requires strict compliance with import-export regulations. The procedure of importing goods is complex, time-consuming, and demands expertise. Recognizing this, SSR Logistics was established with a mission to be a trusted partner in helping businesses with efficient and cost-effective customs clearance procedures for importing goods from China to Vietnam.

Why Choose SSR Logistics?

- Experienced team of professionals;

- Streamlined processes;

- 24/7 dedicated support;

- Competitive Pricing.

SSR Logistics provides customs clearance services for importing goods from China to Vietnam

SSR Logistics’s service for importing goods from China to Vietnam includes:

- Free consultation on import procedures;

- Support in preparing complete and accurate import procedures;

- Submit documents and monitor the progress of import procedures;

- Providing solutions and advice in case of any arising issues;

- Offering import and export cargo transportation services.

With SSR Logistics, you can be assured of a smooth declaration process for importing goods from China to Vietnam. We are committed to providing you with professional, reliable, and efficient services, helping you save time and costs.

Through this article, SSR Logistics hopes that customers have gained an overall understanding of procedure for importing goods from China to Vietnam. To explore more diverse knowledge in the field of logistics, please visit our Logistics Knowledge section.

SSR looks forward to becoming your reliable logistics partner, providing optimal solutions for your importing and exporting business. Should you have any question regarding our services, please feel free to contact us for specific advice.

With our experienced team, extensive network and flexible shipping & customs solutions, SSR Logistics is confident to deliver excellent services to our clients.

Businesses that need customs and import-export, please contact SSR Logistics via Hotline (+84) 911 988 484 or leave your information here for specific advice.

With a modern warehouse system and experienced transportation staff, SSR Logistics provides a variety of additional services such as: customs clearance, warehouse leasing, domestic transportation, international transportation by sea and air, and international express delivery.